NO.PZ2019042401000043

问题如下:

PZ has set up a defined benefit pension scheme with $150m in assets and $135m in liabilities.

We assme that:

The expected annual return of pension assets is 7.5percent. and the volatility is 10percent..

Debt is expected to grow at 5 percent a year and fluctuate at 4.5 percent.

The correlation coefficient between asset income and the growth of liability is 0.7.

Calculate the 95% surplus at risk of the pension.

选项:

A.$14.62 million.

B.$28.37 million.

C.$20.12 million.

D.$7.83 million.

解释:

A is correct.

考点:pension plan surplus at risk计算

解析:

第一步: 计算surplus 的预期增长

Expected surplus growth = growth in asstes – growth in liabilities

Expected surplus growth = ($150m x 0.075)-($135m x 0.05)

Expected surplus growth = $11.25m-6.75m= 4.5m

2019042401000043

第一步: 计算surplus 的预期增长

Expected surplus growth = growth in asstes – growth in liabilities

Expected surplus growth = ($150m * 0.075)-($135m *0.05)

Expected surplus growth = $11.25m-6.75m= 4.5 m

第二步: 计算组合的方差和标准差

Variance of surplus = (150*0.1)^2 + (135*0.045)^2 – 2*(150*0.1*135*0.045*0.7) = 134.33

Volatility of surplus =11.59

第三步:计算组合的VaR

Surplus at risk = 4.5 – 1.65*11.59 = -14.62 m

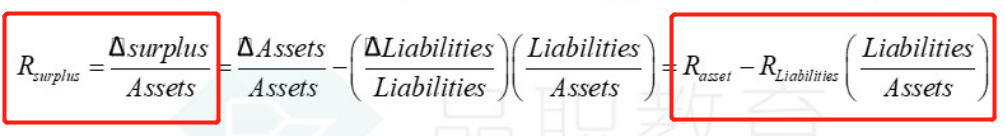

expected surplus为什么不用 μ=A×(1+RA)−L×(1+RL)