NO.PZ201812020100000106

问题如下:

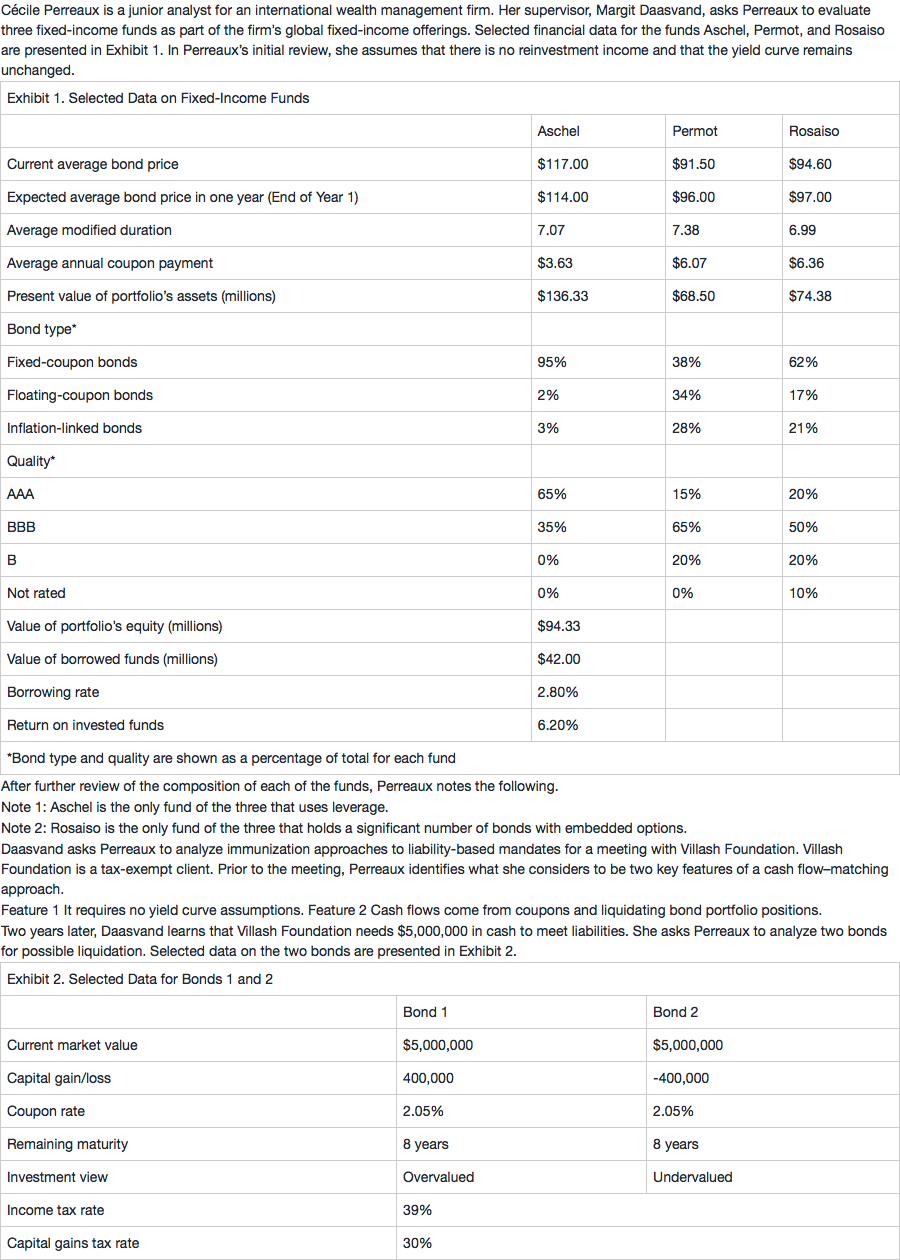

Based on Exhibit 2, the optimal strategy to meet Villash Foundation’s cash needs is the sale of:

选项:

A.100% of Bond 1.

B.100% of Bond 2.

C.50% of Bond 1 and 50% of Bond 2.

解释:

A is correct.

The optimal strategy for Villash is the sale of 100% of Bond 1, which Perreaux considers to be overvalued. Because Villash is a tax-exempt foundation, tax considerations are not relevant and Perreaux’s investment views drive her trading recommendations.

如果这是一个不免税的found (按30%收税),是应该选B——100%bond2还是选C——50% bond 1 和50% bond 2?