NO.PZ202109080500000403

问题如下:

Virginia Cunningham Case Scenario

Virginia Cunningham is a 53-year-old recently widowed mother of two children. Both she and her husband of 25 years, Richard, were Canadian citizens residing in Toronto throughout their lives. Richard had owned several small businesses over his life and in recent years was one of the two founding co-owners of a steel fabricating company. Although Virginia inherited his shares in the company, her interest was bought out for $2.5 million by the surviving owner through a clause in their shareholder agreement. She also received a $1.5 million payout from Richard’s personal life insurance policy.

Richard had always managed the family finances, and Virginia feels overwhelmed with the prospect of managing such a large investment amount. Later today she will be meeting with David Murray, a wealth manager who was recommended by a close friend. Murray previously managed institutional defined benefit plans before moving to his current employer.

In anticipation of the meeting, Virginia did some research on wealth managers and came across an internet blog devoted to wealth management that described how managing institutional portfolios differs from managing portfolios for individuals. The blog made the following points:

Governance and the decision-making process are much more concentrated for individual investors.

The regulatory environment is often different for institutional and individual investors.

Securities are securities, after all, so asset selection is a skill that is easily transferable from institutional to individual portfolios.

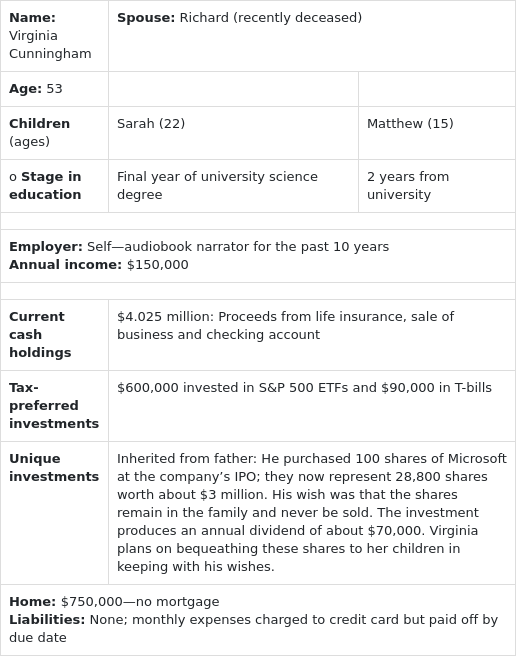

As the meeting starts, Virginia provides Murray some basic information about her family situation, which he summarizes in Exhibit 1.

Exhibit 1

Summary of Notes Collected for the Virginia Cunningham File (all currency amounts are in C$)

After discussing her short- and long-term goals, Murray tells Virginia that he is concerned about her current tax situation. He asks her to confirm that for tax purposes, her cost base for the shares that she inherited from Richard was virtually zero. When she does, he reminds her that Canada has no inheritance tax but a capital gains tax in which one-half of the capital gain is taxable at the individual’s marginal tax rate on the disposal of the property.

The discussion turns to risk. Murray presents Virginia with a widely available questionnaire to assess her attitudes toward risk. Two of the questions are presented in Exhibit 2.

Exhibit 2

Selected Questions from Investment Risk Tolerance Questionnaire

-

When you think of the word “risk,” which of the following words comes to mind first?

Loss

Uncertainty

Opportunity

Thrill

-

You have just finished saving for a “once-in-a-lifetime” vacation. Three weeks before you plan to leave, you lose your job. You would:

cancel the vacation.

take a much more modest vacation.

go as scheduled, reasoning that you need the time to prepare for a job search.

extend your vacation, because this might be your last chance to go first class.

Murray describes the differences between deterministic forecasting and Monte Carlo simulation in investment planning and the traditional and goal-based approach in constructing portfolios. After hearing about these methods, Virginia states that she thinks that the goal-based investing approach is best suited for her needs because

it allows her to specify a level of risk tolerance for each goal,

growth toward each goal on a straight-line basis is much easier to understand, and

it provides the ability to predict the probability of success of each goal.

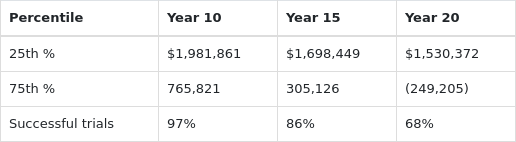

Murray shows Virginia how Monte Carlo simulation can be used in modeling portfolio returns and determining sufficiency analysis for meeting a hypothetical client’s retirement goal. He presents to her a table of portfolio values at specific time intervals and at certain percentiles for a simulation of 10,000 trials. A portion of the table is presented in Exhibit 3.

Exhibit 3

Monte Carlo Simulation Results for Retirement Goal of a Hypothetical Client

When she returns home that evening, Virginia looks again at the exhibit and realizes she is not quite sure what it meant. She settles on three possible interpretations:

Over 20 years, the client failed to meet her objectives 32% of the time.

Over 15 years, the portfolio value would be worth at least 25% of $1,698,449.

Over 20 years, the client will run out of money 75% of the time.

Virginia recalls that Murray stated that there were several benefits from using Monte Carlo simulation in retirement planning. To her best recollection, she lists these benefits as follows:

It aids in quantifying the magnitude of investment shortfalls.

It helps reduce longevity risk.

It can help explore the tax consequences of her Microsoft bequest goal, as indicated in Exhibit 1.

The goals of the two questions in Exhibit 2 are most likely designed to address, respectively, the investor’s:

选项:

A.risk perception and risk capacity.

B.risk perception and risk aversion.

C.risk tolerance and risk perception.

解释:

SolutionB is correct. The first question best addresses the investor’s risk perception, which is a subjective assessment of the risk involved in an investment decision. The second question addresses risk aversion—how the individual behaves when faced with negative outcomes.

A is incorrect. The first question addresses the investor’s risk perception, but the second addresses risk aversion, not risk capacity. Risk capacity is the investor’s ability to accept financial risk. It is determined by the client’s net worth, income, investment time horizon, liquidity needs, and so on.

C is incorrect. The first question addresses the investor’s risk perception, not risk tolerance. Risk tolerance refers to the level of risk that an individual is willing and able to bear; its inverse is risk aversion. The second question addresses risk aversion (or risk tolerance), not risk perception.

Risk aversion, risk tolerance, risk perception