NO.PZ2019012201000056

问题如下:

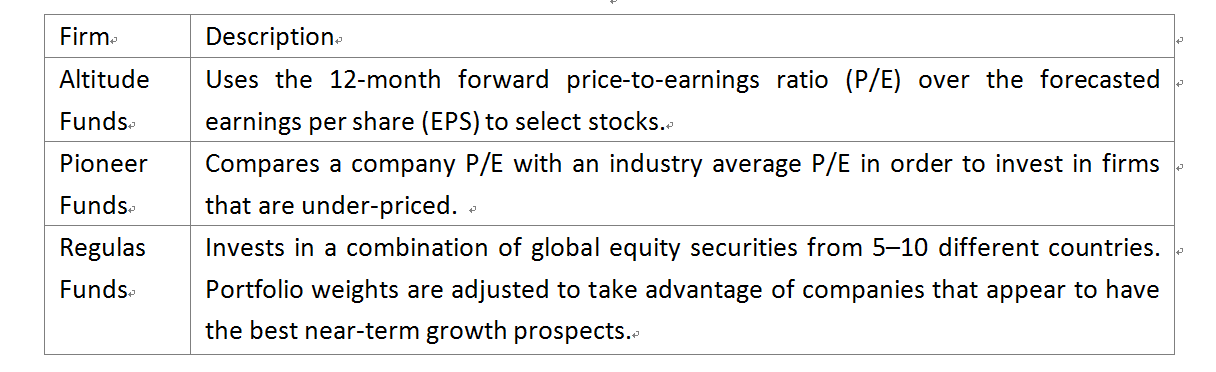

Regulas Funds: Invests in a combination of global equity securities from 5–10 different countries. Portfolio weights are adjusted to take advantage of companies that appear to have the best near-term growth prospects.

Clickman asks Leeter how Regulas Funds determines its equity selections. Leeter says that Regulas uses monthly data from non-traditional, but measurable, sources to determine the influence of customer and government attitudes toward a firm and its products. Leeter also notes that Regulas compares its performance relative to an equity benchmark customized to its strategy and that the factors tend to be more volatile than traditional market factors. He also states that the fund does tend to suffer in performance when exchange rates are volatile.

Using Exhibit 1 and the equity selection process of Regulas Funds, the strategy will most likely benefit from:

选项:

A.a portfolio overlay

a new benchmark

using annual rebalancing

解释:

Regulas Funds will

benefit from a portfolio overlay of derivative securities to eliminate exchange

rate risk.

B is incorrect.

Regulas uses a custom benchmark that is already appropriate for its strategy.

C is incorrect.

Annual rebalancing is too infrequent given the volatile nature of the factors

used by Regulas.

题干哪里可以判断annual Rebalance频率高或者低?