NO.PZ202208100100000401

问题如下:

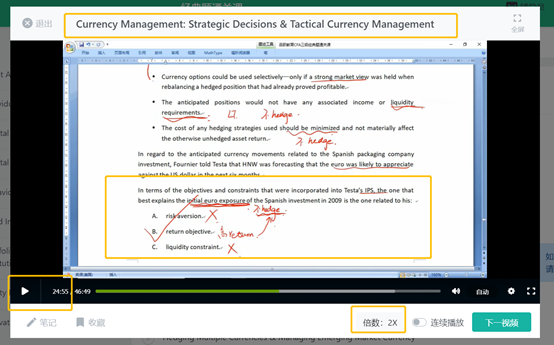

In terms of the objectives and constraints that were incorporated into Testa’s IPS, the one that best explains the initial euro exposure of the Spanish investment in 2009 is the one related to his:

选项:

A.risk aversion.

B.return objective.

C.liquidity constraint.

解释:

Solution

B is correct.

The main goal of Testa’s investment program is the realization of returns based on his perceived superior ability to discover merger and acquisition targets. The position was fully hedged even though both he and his adviser believed that the euro was likely to appreciate over the investment horizon; there was no attempt to exploit that belief either with futures or options (although the use of options was restricted to strong market views at the time of rebalancing of an already winning position).

A is incorrect. Testa is not overly risk averse; his main focus is on the return generated from his investment process.

C is incorrect. Testa’s investment program did not impose any liquidity or income needs on the position.

中文解析:

题目问的是就Testa IPS的投资目标和约束而言,最能解释2009年西班牙投资欧元风的是下列哪一项。

A选项说的是风险。根据题干知道Testa并不是过度规避风险的,相反他主要关注的是投资过程产生的回报。因此A不对,B对。

C选项说的是流动性限制。Testa的投资计划没有对头寸施加任何流动性或收入需求。所以C不对。

这个case是课后题吗?有视频讲解吗