NO.PZ2018120301000054

问题如下:

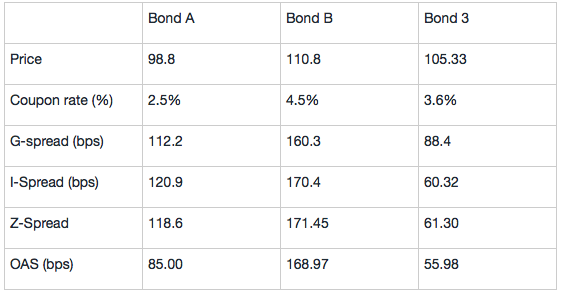

Wang, a credit analyst in a securities firm, collects the following financial data for 3 different BBB-Rated bonds

According to the information above, Wang made the following statements:

Statement 1: because the bond B’s OAS and its other spreads are more or less the same, the bond B is most likely an option-free bond.

Statement 2: because Bond A’s Z-spread is much larger than its OAS, bond A is most likely a callable bond, and the difference between z-spread and OAS (118.6 - 85) is the premium for the embedded call options.

According to the information above, which of the following is correct?

选项:

A.Statement 1 is correct.

B.Statement 2 is correct.

C.Both statement 1 and 2 are correct.

解释:

C is correct.

考点:考察对各Spread的理解

解析:两个Statement都是正确的。对于第一个Statement,因为Bond B的Z-spread和其OAS非常相近,意味着对持有风险债券的补偿,和风险债券剔除Option之后的补偿相近,则Bond B很有可能是一支option-free bond。对于第二个Statement,Z-spread和OAS之差,是对embedded call option的补偿。

可以这样理解吗?

callable bond意味着客户吃亏,卖的更便宜,所以Z spread就更大?所以Z>OAS,就代表callable bond