品职CFA错题本

写在前⾯的话:

临到考前,相信很多⼩伙伴在“预习”完那么多科⽬,会对⾃⼰产⽣怀疑,⽽且都会有经典的“两道题”是不会的。

分别是这道也不懂,那道也不懂。

ORZ。。。。

是不是这样就没救了呢?

当然不会啊。

虽然距离考试只有不到2周的时间啦,各位小伙伴们千万不要放弃治疗哦,为了在最后的时候帮助各位小伙伴,我们品职团队已经先祭出了【CFA千人计划的第一弹(19.9元喜茶价)】,目前千人计划已经招募结束啦,听完课的你们是不是觉得还是没有感觉?

贴心的我们推出了千人计划第二弹-千人模考,赶紧戳👇的链接去看看怎么参加哈!(重要的事情说三遍,是免费免费免费的哦!)

【品职CFA终极助考第二弹】0元CFA千人模考-新增移动APP版

除了品职千人计划以外,还有福利凶!我们在考前还为⼤家订制⼀款新栏⽬-【品职CFA错题本】,发送⼀波精选的各科问题,⾥⾯会有助教们的总结分析,希望能给⼤家最后再捞点分。

毕竟错过的题,我们争取不要⼀错再错了哦。

今天让我们先来看看公司理财。

考点:对Incremental Cash Flow的理解

精选问答1:

When a company is doing capital budgeting, an appropriate estimate of the incremental cash flows from a project is least likely to include:

A. Externalities

B. Interest costs

C. Opportunity costs

答案:

B is correct.

Costs to finance the project are taken into account when the cash flows are discounted at the appropriate cost of capital; including interest costs in the cash flows would result in double-counting the cost of debt.

解题思路:

考点是在对Incremental Cash Flow的理解。

Incremental Cash Flows是指:某项投资决策带来的增量现金流。即:如果不做这个决策,现金流是A,做了该决策之后现金流是B,那么B-A就是这个决策的增量现金流(Incremental Cash Flows)。

比如,期初投资5百万修高速路,向过路车辆收费每年会带来Cash 100万,这100万是在计算增量现金流(Incremental CF)时需要考虑的。

当然投资还需要考虑机会成本,因为这5million投资了高速路,就不能投资其他项目,因此会有Opportunity costs,这部分影响也要考虑在增量现金流里。

第三个在增量现金流里面需要考虑的是外溢效应(Externalities),比如修了高速之后,过路车辆的加油收入是100万,推动经济发展的收入是100万等等。这个Externalities就是指由于这项投资决策带来的其他事项的影响。这个外溢效益的现金流也需要包含在Incremental CF里。

当然外溢效应也可能是负的,比如可乐投资生产无糖可乐;那么含糖可乐的销量可能减少;这种影响在计算投资无糖可乐的现金流时,也要算在Incremental Cash Flow里,才能正确反映投资决策的影响。这种负的外溢效应有一个名词叫做Cannibalization,需要注意一下!

在现金流里面,是不考虑融资成本的;例如通过Debt融资,利息是不算在CF里的。因为融资成本是在求项目NPV时,考虑在了折现率里(WACC)。

易错点分析:

根据品职题库统计数据显示,本题是一级公司理财里错误率非常高的一题,很多同学会把融资利息费用算到分子的现金流里,这是错误的算法。如果把融资成本算进增量现金流里面,再算NPV时,不但分子的现金流包括了融资成本的影响,分母的折现率(WACC)也包括了融资成本的影响,这样这个影响因素就考虑了2次,算出来的NPV不准。

考点:边际成本

精选问答2:

Two years ago, a company issued $20 million in long-term bonds at par value with a coupon rate of 9 percent. The company has decided to issue an additional $20 million in bonds and expects the new issue to be priced at par value with a coupon rate of 7 percent. The company has no other debt outstanding and has a tax rate of 40 percent. To compute the company's weighted average cost of capital, the appropriate after-tax cost of debt is closest to:

A. 4.2%

B. 4.8%

C. 5.4%

答案:

A is correct.

The relevant cost is the marginal cost of debt. The before-tax marginal cost of debt can be estimated by the yield to maturity on a comparable outstanding. After adjusting for tax, the after-tax cost is 7(1 − 0.4) = 7(0.6) = 4.2%.

解题思路:

在一级Corporate Finance里面,计算WACC时,使用的是融资的边际成本,(Marginal cost of Capital)。其背后的逻辑就是,在CF里考虑的是新项目成本与收益的分析,考虑的是新项目投与不投的问题,与做决策更相关的是项目的边际收益和边际成本之间的关系;

因此,计算出来的融资成本是边际成本才更适合用来分析新项目的盈利能力,这样做到匹配。所以本题用Debt的边际税前成本7%,这个融资成本是该公司最新的融资成本。而不用考虑2年前9%的融资成本。

在一级的原版书教材里面有WACC = Marginal Cost of Capital的说法。

下图红线部分来自原版书:

易错点分析:

根据品职题库统计数据显示,本题易错在B选择。很多同学给了第一次融资(20 million)50%的权重,这笔融资按9%的税前融资成本算;给了第二次融资(20 million)50%的权重,这笔融资按7%的税前融资成本算,最终算下来的成本是4.8%。虽然看上去比较“科学”,但注意,一定是与现在相关的融资成本,才能做到成本与收益匹配分析。9%只能反映过去,再做项目决策时,不能用过去的成本进行新项目收益分析,除非当前的融资成本与过去一样。

考点:公司治理

精选问答3:

Which of the following statements regarding corporate shareholders is most accurate?

A. Cross-shareholdings help promote corporate mergers.

B. Dual-class structures are used to align economic ownership with control.

C. Affiliated shareholders can protect a company against hostile takeover bids.

答案:

C is correct.

The presence of a sizable affiliated stockholder (such as an individual, family trust, endowment, or private equity fund) can shield a company from the effects of voting by outside shareholders.

解题思路:

本题属于比较细节的题目了,也是错误率较高的题目。三个选项属于了解记忆性质的知识,刚好利用本题记忆知识点。

其中B选项刚好说反了,Dual-class是使得Voting rights (Control rights)和Economic ownership不对等的。

理论上一份股票对应一份投票权;但是Dual-class下,创始人高管等的Share存在一票多权的情况。比如创始人高管的A-share对应的可能是一份股票有投票权10票。而普通股东的B-share是一份股票对应一个投票权。

这样就刚好把控制权和Economic ownership分开了。股东虽然拥有相应份额share的Economic Ownership,但是控制权比例不对应,因此该设计将Economic ownership和Control rights割裂开了。

而对于C选项,Affiliated shareholders属于公司拥有20%及以上Voting rights的投资者。其中C选项是说:Affiliated shareholders可以帮助公司抵御恶意收购。C选择是正确的。

比如,规定一个事项要通过2/3的股东同意才能通过,那显然Affiliated shareholders就可以在敌意收购中起到重要作用。

易错点分析:

本题考察的点比较细致,属于品职题库数据统计出的高频错误。可以利用本题记住知识点。

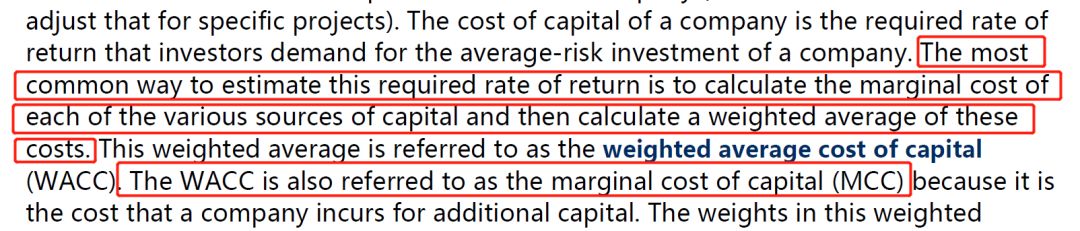

考点:计算 Country Risk Premium

精选问答4:

An analyst gathered the following information about the capital markets in the United States and in Paragon, a developing country.

Based on the analyst’s data, the estimated country equity premium for Paragon is closest to:

A. 4.29%.

B. 6.00%.

C. 8.40%.

答案:

C is correct.

The country equity premium can be estimated as the sovereign yield spread times the volatility of the country’s stock market relative to its bond market. Paragon’s equity premium is

(10.5% –4.5%) × (35%/25%) = 6% × 1.4 = 8.40%.

解题思路:

易错点分析:

品职题库统计数据里有一道类似的题属于高频错误;容易犯的错误一是计算CRP时记错公式。二是在计算要求回报率(Cost of equity)时,如果有CRP,注意CRP是加在Beta的括号里面。

考点:计算Cost of capital、Pure play计算Equity beta、计算Cost of debt,计算Cost of equity

精选问答5:

Boris Duarte, CFA, covers initial public offerings for Zellweger Analytics, an independent research firm specializing in global small-cap equities. He has been asked to evaluate the upcoming new issue of TagOn, a US-based business intelligence software company.

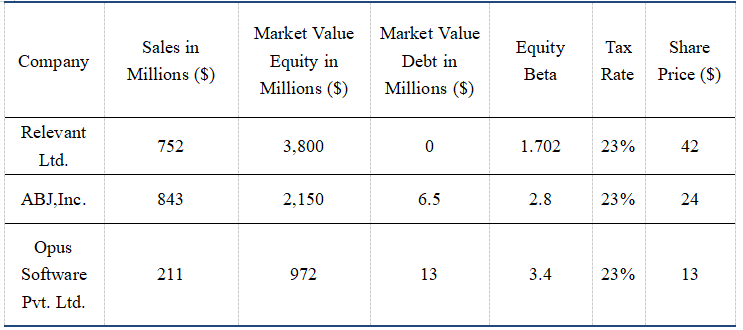

The industry has grown at 26 percent per year for the previous three years. Large companies dominate the market, but sizable "pure-play" companies such as Relevant, Ltd., ABJ, Inc., and Opus Software Pvt. Ltd also compete. Each of these competitors is domiciled in a different country, but they all have shares of stock that trade on the US NASDAQ. The debt ratio of the industry has risen slightly in recent years.

Duarte uses the information from the preliminary prospectus for TagOn’s initial offering. The company intends to issue 1 million new shares. In his conversation with the investment bankers for the deal, he concludes the offering price will be between $7 and $12.

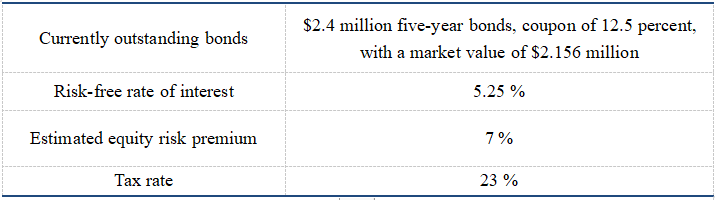

The current capital structure of TagOn consists of a $2.4 million five-year non-callable bond issue and 1 million common shares. Other information that Duarte has gathered:

The marginal cost of capital for TagOn, based on an average asset beta of 2.27 for the industry and assuming that new stock can be issued at $8 per share, is closest to:

A. 20.5 percent.

B. 21.0 percent.

C. 21.5 percent.

答案:

C is correct.

For debt: FV = 2,400,000; PV = 2,156,000; N = 10; PMT = 150,000

Solve for I → I = 0.07748 → YTM = 15.5%

Before-tax cost of debt = 15.5%

Market value of equity = 1 million shares outstanding + 1 million newly issued shares= 2 million shares at $8 = $16 million

Total market capitalization = $2.156 million + $16 million = $18.156 million

Levered beta = 2.27 {1 + [(1 − 0.23)(2.156/16)]} = 2.27 (1.1038) = 2.5055

Cost of equity = 0.0525 + 2.5055 (0.07) = 0.2279 or 22.79%

Debt weight = $2.156/$18.156 = 0.1187

Equity weight = $16/$18.156 = 0.8813

TagOn’s MCC = [(0.1187)(0.155)(1 − 0.23)] + [(0.8813)(0.2279)]= 0.01417 + 0.20083 = 0.2150 or 21.50%

解题思路:

本题属于一道综合性非常强的题目,比较难,需要计算的数据较多,需要一步步梳理。题干让求Cost of capital,所以是使用WACC计算。需要先计算出Cost of debt,Cost of equity,即各项资金来源的成本,以及各项资金的权重。

题目已经给定了公司之前发行的Bond的相关数据,以及市场价格;根据市场价格反求出来的Bond yield就反映了公司当前通过Debt的融资成本。这是第一步,通过Bond的市场数据以及Bond属性计算Yield。注意算出来的Yield是税前融资成本。

第二步需要计算公司的Equity融资成本,从题干中给出的数据判断,应该是使用CAPM模型计算Cost of equity,所以这一步需要计算Equity beta。因为可比公司的Asset beta是2.27已知,所以根据Pure play的方法,计算出该公司的Equity beta:

2.27 {1 + [(1 − 0.23)(2.156/16)]} = 2.27 (1.1038) = 2.5055。算出来Equity beta后,通过CAPM计算Cost of equity.

有了两个资金来源的成本,第三步使用WACC计算Cost of capital,这一步需要计算各项资金来源的权重。

易错点分析:

本题计算较为复杂,需要算的数据较多。做题前要先理清思路看看用什么方法求解,缺什么数据,然后看看能否在题干中寻找到这些数据,如果没有这些数据能不能通过已知求出。

考点:应用Project Beta计算项目的融资成本

精选问答6:

Brandon Wiene is a financial analyst covering the beverage industry. He is evaluating the impact of DEF Beverage’s new product line of flavored waters. DEF currently has a debt-to- equity ratio of 0.6.

The new product line would be financed with $50 million of debt and $100 million of equity. In estimating the valuation impact of this new product line on DEF's value, Wiene has estimated the equity beta and asset beta of comparable companies. In calculating the equity beta for the product line, Wiene is intending to use DEF's existing capital structure when converting the asset beta into a project beta. Which of the following statements is correct?

A. Using DEF’s debt-to-equity ratio of 0.6 is appropriate in calculating the new product line's equity beta.

B. Using DEF’s debt-to-equity ratio of 0.6 is not appropriate, but rather the debt-to-equity ratio of the new product, 0.5, is appropriate to use in calculating the new product line’s equity beta.

C. Wiene should use the new debt-to-equity ratio of DEF that would result from the additional $50 million debt and $100 million equity in calculating the new product line's equity beta.

答案:

B is correct.

The debt-to-equity ratio of the new product should be used when making the adjustment from the asset beta, derived from the comparables, to the equity beta of the new product.

解题思路:

这家叫DEF的公司,其原本的公司资本结构是:Debt-to-Equity = 0.6;

目前该公司在为新项目融资,新项目融资的资本结构是:Debt-to-Equity = 0.5 (50 Debt vs 100 Equity)题干说在计算新项目的Project Beta时,使用公司原来的杠杆0.6,错误就在这点;

为了反映投资该项目的风险,在计算Project Beta时,应该使用的是新项目的杠杆0.5,而不是公司的杠杆0.6,以真实的反映该项目的融资成本,从而在分析收益成本时做到匹配。B选项描述的就是这点;

由于公司为新项目融资的杠杆比例是0.5,而公司原来的Capital Structure比例是0.6。因此,新项目的融资比例和公司已有的比例不同,完成这笔融资之后,公司的资本结构就会发生变化,会从原来的0.6下降一点。我们记这个公司新的资本结构是A。

C选项表达的意思就是使用这个公司新的资本结构A计算新项目的Beta。这点是错误的,应该使用的是项目的融资比例。

易错点分析:

本题也属于品职题库数据分析的高频错误点,在有问必答里也有学员问B、C两个选项的区别。注意,在审题时一定要通读选项,不要只读半句,在CFA的题目里,经常会出现选择之间的差距就在某些词上,所以读题时要通读,并且小心陷阱!

考点:NPV Profile的理解

精选问答7:

An investment has an outlay of 100 and after-tax cash flows of 40 annually for four years. A project enhancement increases the outlay by 15 and the annual after-tax cash flows by 5. As a result, the vertical intercept of the NPV profile of the enhanced project shifts:

A. up and the horizontal intercept shifts left.

B. up and the horizontal intercept shifts right.

C. down and the horizontal intercept shifts left.

答案:

A is correct.

The vertical intercept changes from 60 to 65 (NPV when cost of capital is 0%), and the horizontal intercept (IRR, when NPV equals zero) changes from 21.86 percent to 20.68 percent.

解题思路:

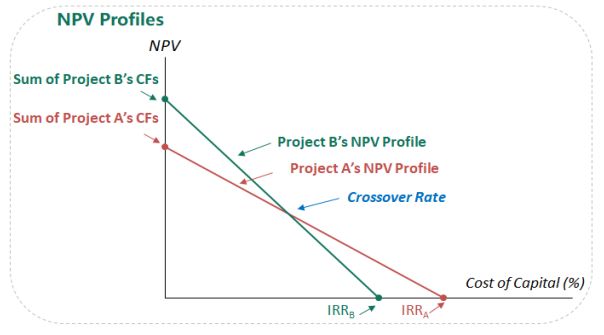

要解这道题,就一定要理解NPV profile代表什么意思,坐标轴分别是什么。

NPV Profile的横轴X轴:是不同的折现率(不同的cost of capital);纵轴是项目的NPV;

所以,这个图反应的关系就是:一个项目现金流确定的情况下,在不同的Cost of capital下,项目NPV的大小。

如下图,就是两个项目A,和B的NPV Profile:

红色和绿色线分别是项目A,项目B的NPV Profile.

这条线与纵轴的交点就代表: Cost of capital 为零时,项目NPV的大小;根据计算NPV的公式,既然折现率为0,实际上算出来的结果就是项目所有现金流的简单加总(不用折现);所以对于本题:

现金流改变之前为:-100, 40, 40, 40, 40;所以与纵轴交点是:60;

现金流改变之后为:-115, 45, 45, 45, 45;与纵轴交点是:65

因此NPV Profile与纵轴的交点上升;

NPV Profile与横轴交点就是NPV=0时,Cost of capital的大小,按照IRR的定义,实际上与横轴的交点就是项目的IRR。

所以计算横轴交点要使用计算器计算该项目的IRR。

顺便提一下,在其他类似的题目中,有学员提到两个项目NPV Profile的交点(Crossover rate)代表什么意思,是不是意味着两个项目的IRR相等。注意,这个交点只能说明在这个对应的Cost of capital情况下,两个项目的NPV相等,不一定说明两个项目的IRR相等。如果两个项目的交点在横轴X轴上,那么两个项目的IRR相等。

易错点分析:

纵轴的交点代表的是项目现金流的简单加总,不考虑折现。一些同学在计算与纵轴的交点时,误以为是项目折现后的现金流;或者是项目的期初现金流流出(Outflows),这点要注意。

好啦,一级公司理财的精选问答就到这里结束啦,最后再提醒一下哦,品职CFA千人模考在火热进行中,小伙伴赶紧去了解一下如何参与哈!

【品职CFA终极助考第二弹】0元CFA千人模考-新增移动APP版