NO.PZ2018111501000022

问题如下:

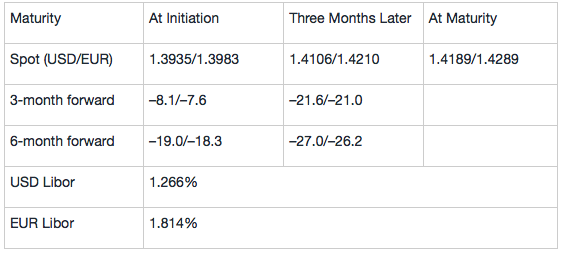

Testa acquireda Spanish packaging company. The Spanish investment involved Testa acquiring200,000 shares of a packaging company at EUR90 per share. He decided to fullyhedge the position with a six month USD/EUR forward contract. Details of theeuro hedge at initiation and three months later are provided in Exhibit 1.

Exhibit 1 2009 Spot and Forward USD/EUR Quotes (Bid-Offer) and Annualized Libor Rates

Using Exhibit1, if the Spanish shares had been sold after three months,how would the manager do to close the initial transaction?

选项:

A.

Sell EUR 18 million at spot.

B.

Sell EUR 18 million three months forward.

C.

Buy EUR 18 million three months forward.

解释:

C is correct.

考点:Mark-to-marketvalue of Forward Contract

解析:

Testa现在持有18m的欧元股票,本币是USD,外币是EUR。

0时刻:持有外币EUR资产,担心外币EUR贬值,因此short forward on USD/EUR,期限为6个月,合约规模是18million。

3个月:这些欧元的股票被卖掉了,因此之前在0时刻签订的期限为6个月的forward合约,现在用不到了,需要平仓平掉,因此需要签反向头寸进行平仓。

又因为之前的合约还剩下3个月到期,因此我们的反向头寸的合约期限也应该是3个月,面值也仍然是18million。因此我们需要long 3个月到期的规模为18million的forward合约,选C。

你好,我想问一下,股票卖掉了,但是卖掉之后获得的还是欧元,那么,不是还是存在汇率风险吗?为什么要平仓呢。