NO.PZ2018111303000059

问题如下:

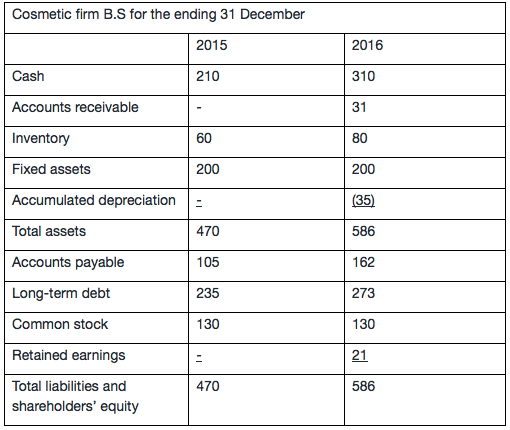

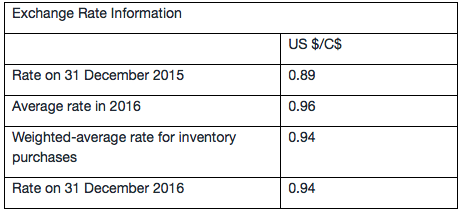

Ulta Beauty is a US-BASED corporation that sells cosmetic. Its Canadian subsidiary, Cosmetic firm, operates solely in Canada. It was created on 31 December 2015, and uses US dollar as its functional currency. Assume all fixed assets were bought when the company was created.

The following table shows the financial statement information for the years ended 2015 and 2016:

If the functional currency for Cosmetic firm were changed to the Canadian dollar,the consolidated financial statements for Ulta Beauty would begin to recognize:

选项:

A.realized gains and losses on monetary assets and liabilities.

B.realized gains and losses on non-monetary assets and liabilities.

C.unrealized gains and losses on non-monetary assets and liabilities.

解释:

C is correct.

考点:风险敞口exposure。

解析:If the functional currency were changed from the parent currency (US dollar) to the local currency (Canadian dollar), the current rate method would replace the temporal method. The temporal method ignores unrealized gains and losses on non-monetary assets and liabilities, but the current rate method does not.

在temporal下 exposure=MA- ML, MA & ML都是日常活动所需要的,它们的translation G/L在短期内就会realized,所以在I.S中体现(反应经济实质)

而current method,exposure= TA-TL,在资产负债表日需要revalued(并表需要),只有整个公司卖掉才能realized,所以现在是unrealized G.L,确认在OCI (不用反应经济实质)

current method包含的了total asset and total liability,所以没有忽略non-monetary asset/liability,而temporal下只有monetary asset/liability,不包含non-monetary,且它们是unrealized,所以忽略了。

Because under the temporal method records translation G/L on the I/S

The current rate records it on B/S

So shouldn't a shift to temporal method mean it would be realized G/L, thus the answer is B instead of C?