NO.PZ2023032701000036

问题如下:

The following are the financial statements in Exhibits 1 and 2. McLaughlin’s fiscal year ends 31 December.

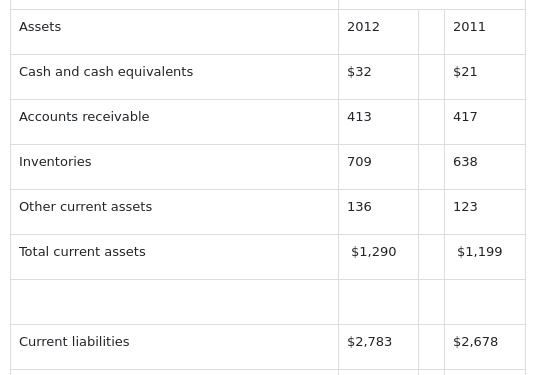

Exhibit 1 McLaughlin Corporation Selected Financial Data ($ millions, except per share amounts)

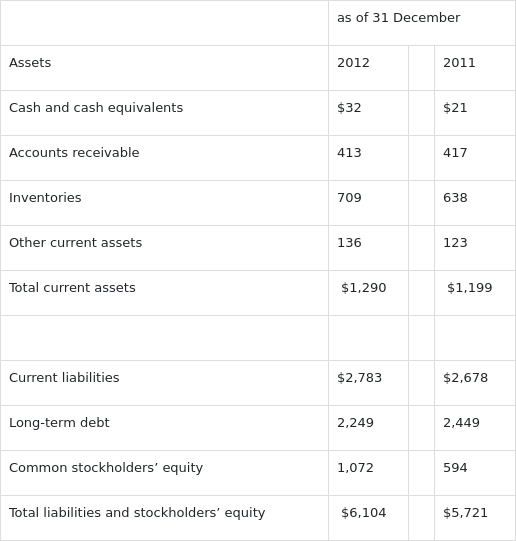

Exhibit 2 McLaughlin Corporation Consolidated Balance Sheets ($ millions)

McLaughlin’s FCFF ($ millions) for 2012 is closest to:

选项:

A.$485

$418

$460

解释:

FCFF = NI + NCC + Int(1 – Tax rate) – FCInv – WCInv

Net income (given) = $626; Non-cash charges (depreciation, given) = $243; Interest expense (given) = $186; Tax rate = 294/920 = 32%; Fixed capital investment (given) = $535

FCFF = 626 + 243 + 186(1 – 0.32) – 535 – (–25) = 485.48 = $485 million

$418 is incorrect. It uses t not (1 – t).

FCFF = 626 + 243 + (186 × 0.32) – 535 – (–25) = 418.2 = $418 million

$460 is incorrect. It ignores working capital investment.

FCFF = 626 + 243 + 186 × (1 – 0.32) – 535 = 460.48 = $460 million

我看讲义里写:WC不包括现金及现金等价物、notes payable和long term debt,为什么这道题没有把long term debt减掉?