NO.PZ2021060201000009

问题如下:

Xu and Johnson is co-worker for the south University Endowment Fund (the Fund). The Fund’s investment committee recently decided to add hedge funds to the Fund’s portfolio to increase diversification.And then they discuss various hedge fund strategies that might be suitable for the Fund. Johnson tells Xu the following:

Statement 1

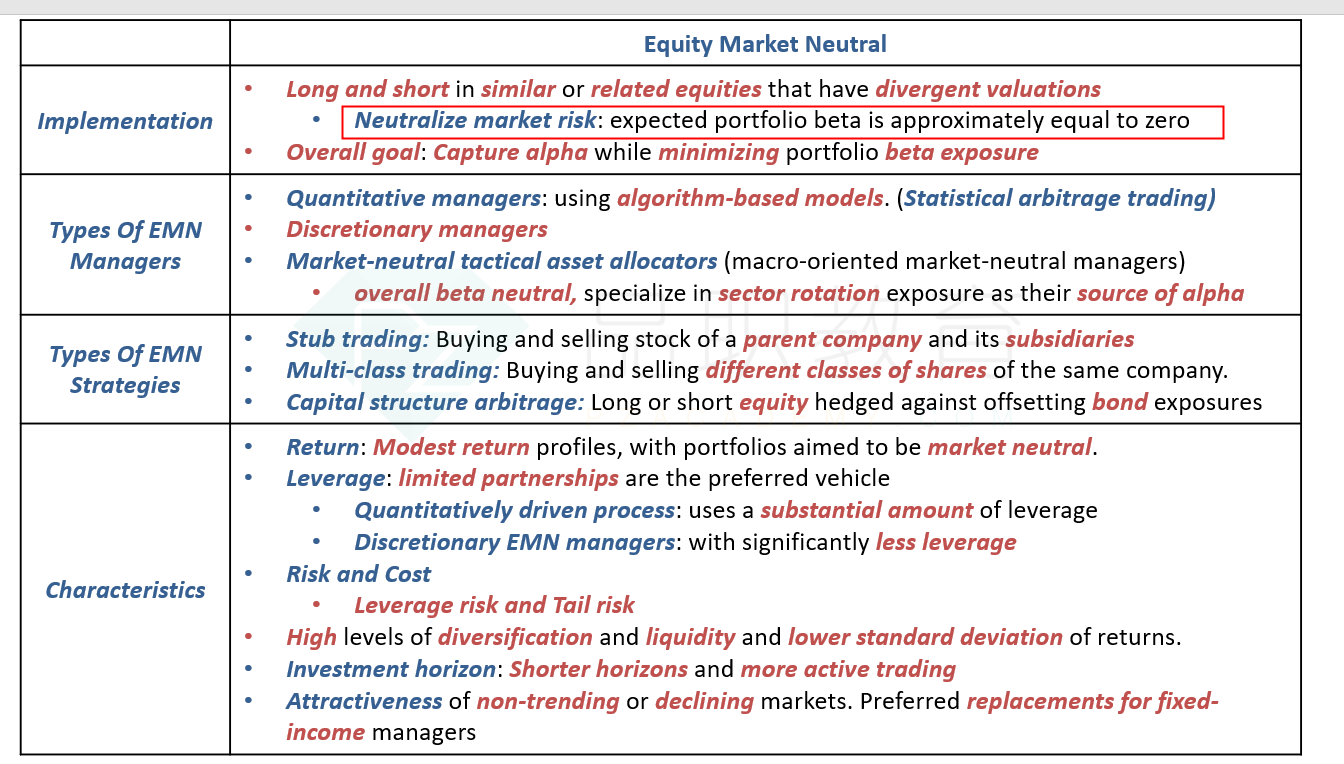

Relative value strategies tend not to use leverage.

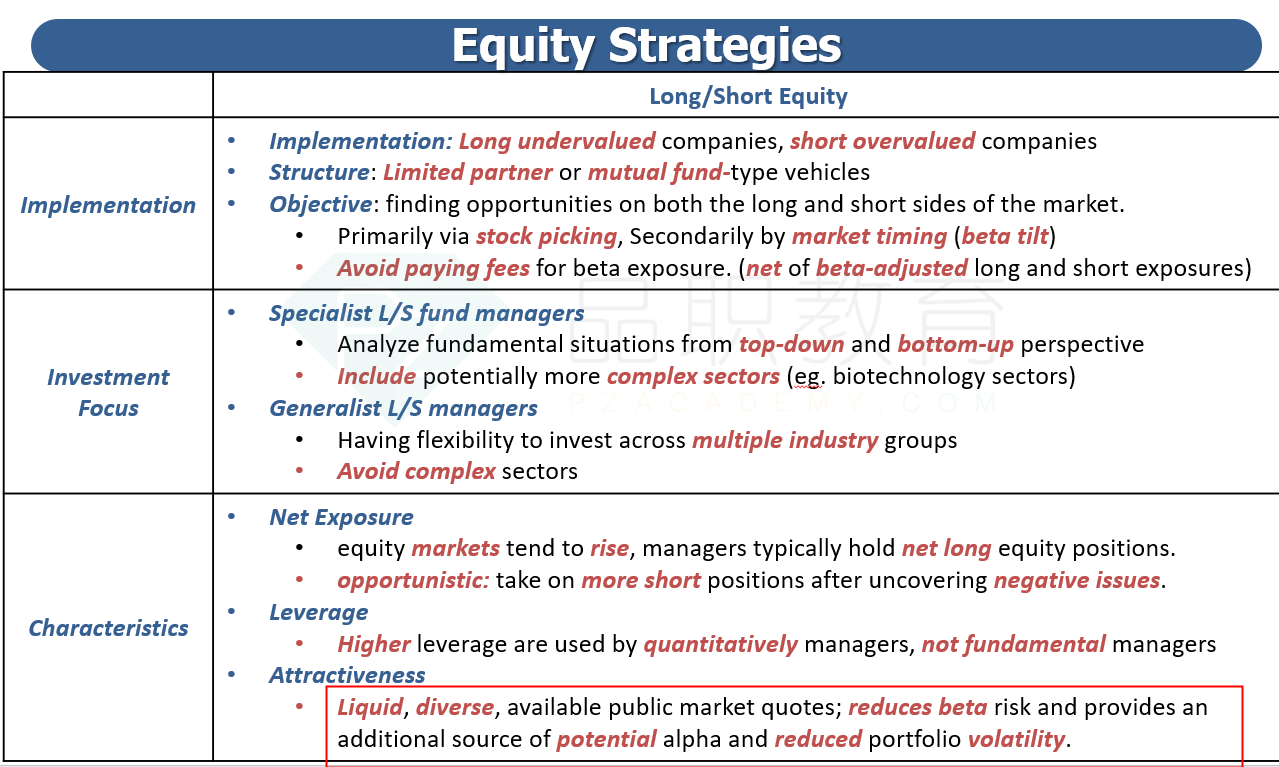

Statement 2 Long/short equity

strategies usually do not exposed to equity market beta risk.

Statement 3 Global macro strategies will naturally have higher volatility in the return profiles typically

delivered.

Which of Johnson’s three statements regarding hedge fund strategies is correct?

选项:

A.Statement 1

Statement 2

Statement 3

解释:

C is correct.

C是正确的。 Global macro investing 虽然很可能会带来资产类别和投资方法多样化的天然好处,但这样也会带来回报的更高波动性。由于投资的多样化使得不同的factor带来的不可预见或者相反效果的的factor导致波动性很大;因此,与其他对冲基金策略相比,Global macro基金经理往往会产生更不稳定和更不均匀的回报流。

A 是不正确的,因为Relative value strategies 倾向于多使用杠杆,风险也是来自杠杆,尤其是在市场萧条时期。在一般的市场条件下,成功的Relative value strategies 可以随着时间的推移赚取信用、流动性或波动性溢价。然而,在杠杆过高、信用质量恶化、流动性不足和波动性飙升的萧条时期,Relative value strategies 可能会导致亏损。

B 是不正确的,因为long/short equity strategies往往面临一些正常的股票市场贝塔风险,但比简单的only long的策略的贝塔相对小。鉴于股票市场长期趋于上涨,所以大多数long/short equity strategies基金经理通常持有净多头股票头寸,而一些经理保持空头头寸是为了对冲意外的市场低迷。

Statement 2 Long/short equity strategies usually do not exposed to equity market beta risk.

这句话为什么不对呢? 讲义里写L/S equity strategy avoid paying fees for beta exposure (net of beta-adjusted long and short exposure)这不是说避免beta风险吗