Mike and Kerry Armstrong are a married couple who recently retired with total assets of $8 million. The Armstrongs meet with their financial advisor, Brent Abbott, to discuss three of their financial goals during their retirement.

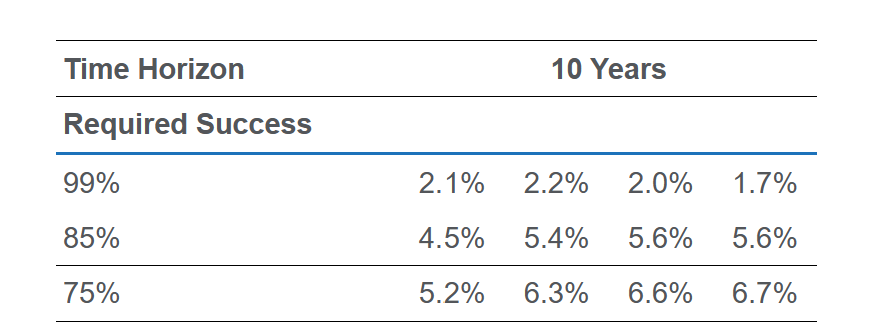

- Goal 1: An 85% chance of purchasing a vacation home for $5 million in five years.

- Goal 2: A 99% chance of being able to maintain their current annual expenditures of $100,000 for the next 10 years, assuming annual inflation of 3% from Year 2 onward.

- Goal 3: A 75% chance of being able to donate $10 million to charitable foundations in 25 years.

Abbott suggests using a goals-based approach to construct a portfolio. He develops a set of sub-portfolio modules, presented in Exhibit 1. Abbott suggests investing any excess capital in Module A.

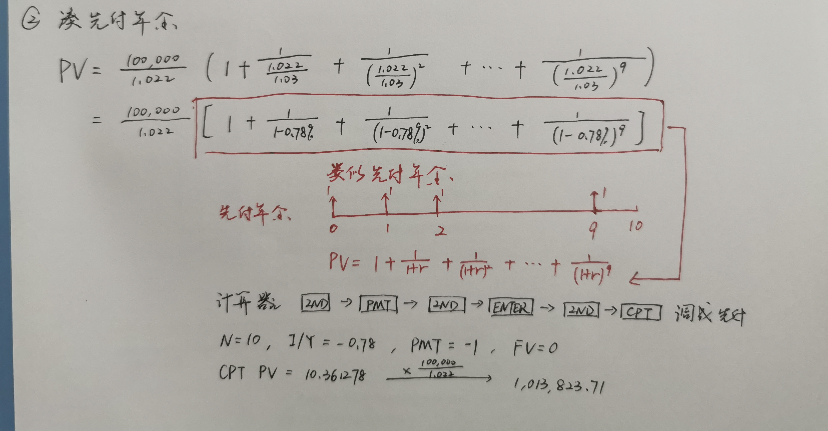

计算器怎么算呀?

BGN模式下:N = 10, FV = 0, PMT = 0.1, I/Y = (1+2.2%)/(1+3%)-1 = -0.78

CPT PV = -1.04 之后得出数字再除1.022%?