NO.PZ202206140600000202

问题如下:

Based on the client’s investment mandate, the most appropriate appraisal measure for McNeil to use is the:选项:

A.Sortino ratio. B.Treynor ratio. C.information ratio.解释:

SolutionA is correct. Given that the fund mandate requirement is for a short-term return in excess of the risk-free rate, the Sortino ratio is a more appropriate measure because it penalizes returns below a specific return—in this case, 1.5% above the risk-free rate.

B is incorrect. The Treynor ratio penalizes returns below the risk-free rate. It will not measure the fund’s ability to meet the requirement of a short-term return in excess of the risk-free rate.

C is incorrect. The information ratio evaluates the portfolio return relative to a benchmark. It will not measure the fund’s ability to meet the requirement of a short-term return in excess of the risk-free rate.

“从Treynor ratio的公式可以看出,Treynor ratio的benchmark,并不是1.5% + risk free rate,而是一个index。”

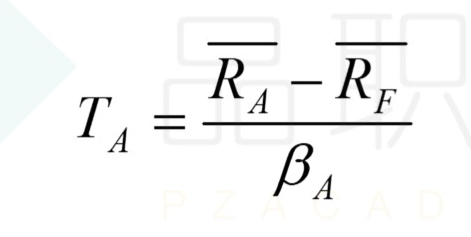

Treynor ratio的分子不是减去的无风险收益率吗?题目和课件都是减risk free rate啊