NO.PZ201709270100000204

问题如下:

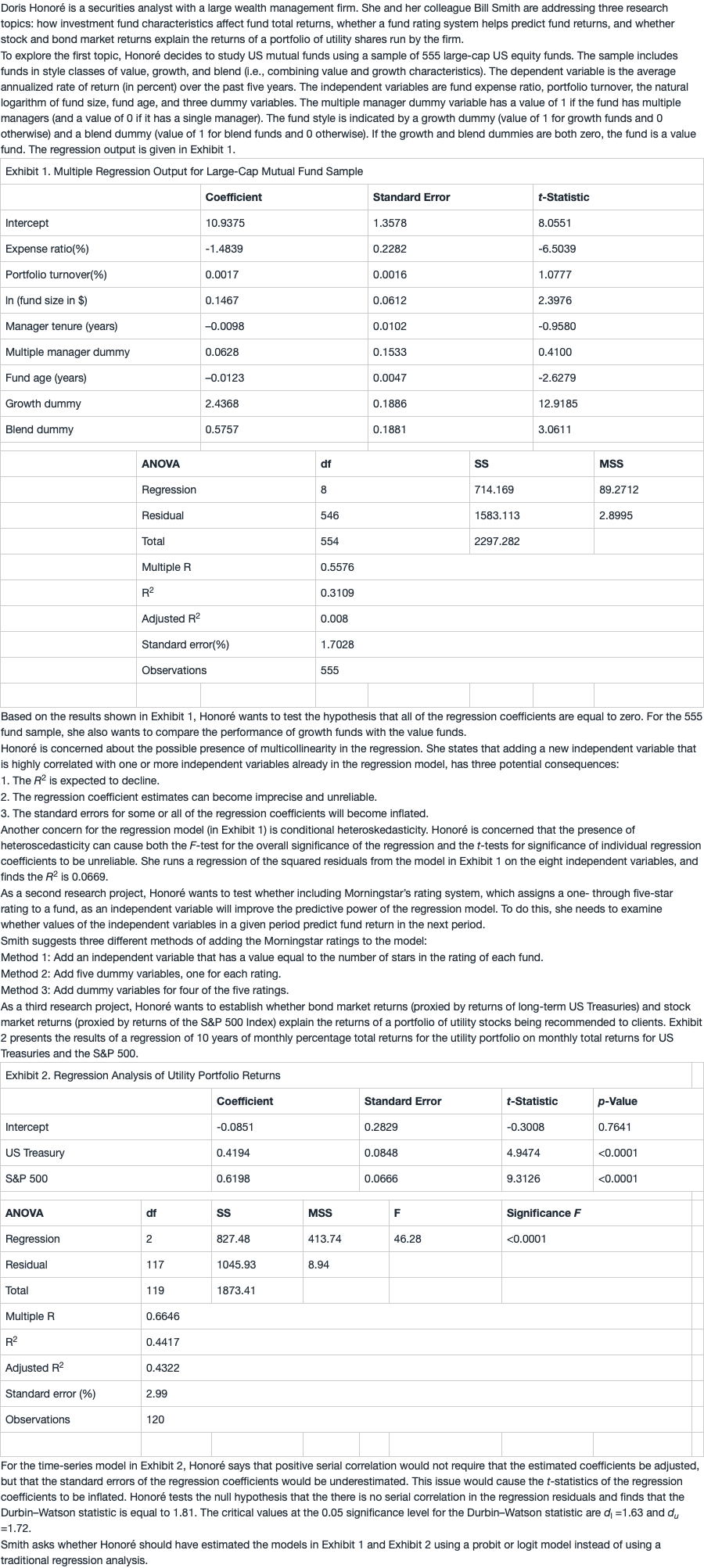

4. Which of the three methods suggested by Smith would best capture the ability of the Morningstar rating system to predict mutual fund performance?

选项: Method

1

Method 2

C.Method 3

解释:

C is correct. Using dummy variables to distinguish among n categories would best capture the ability of the Morningstar rating system to predict mutual fund performance. We need n – 1 dummy variables to distinguish among n categories. In this case, there are five possible ratings and we need four dummy variables. Adding an independent variable that has a value equal to the number of stars in the rating of each fund is not appropriate because if the coefficient for this variable is positive, this method assumes that the extra return for a two-star fund is twice that of a one-star fund, the extra return for a three-star fund is three times that of a one-star fund, and so forth, which is not a reasonable assumption.

辛苦老师详细翻译解释一下方法一的解析,谢谢!

Adding an independent variable that has a value equal to the number of stars in the rating of each fund is not appropriate because if the coefficient for this variable is positive, this method assumes that the extra return for a two-star fund is twice that of a one-star fund, the extra return for a three-star fund is three times that of a one-star fund, and so forth, which is not a reasonable assumption.