NO.PZ2025022501000081

问题如下:

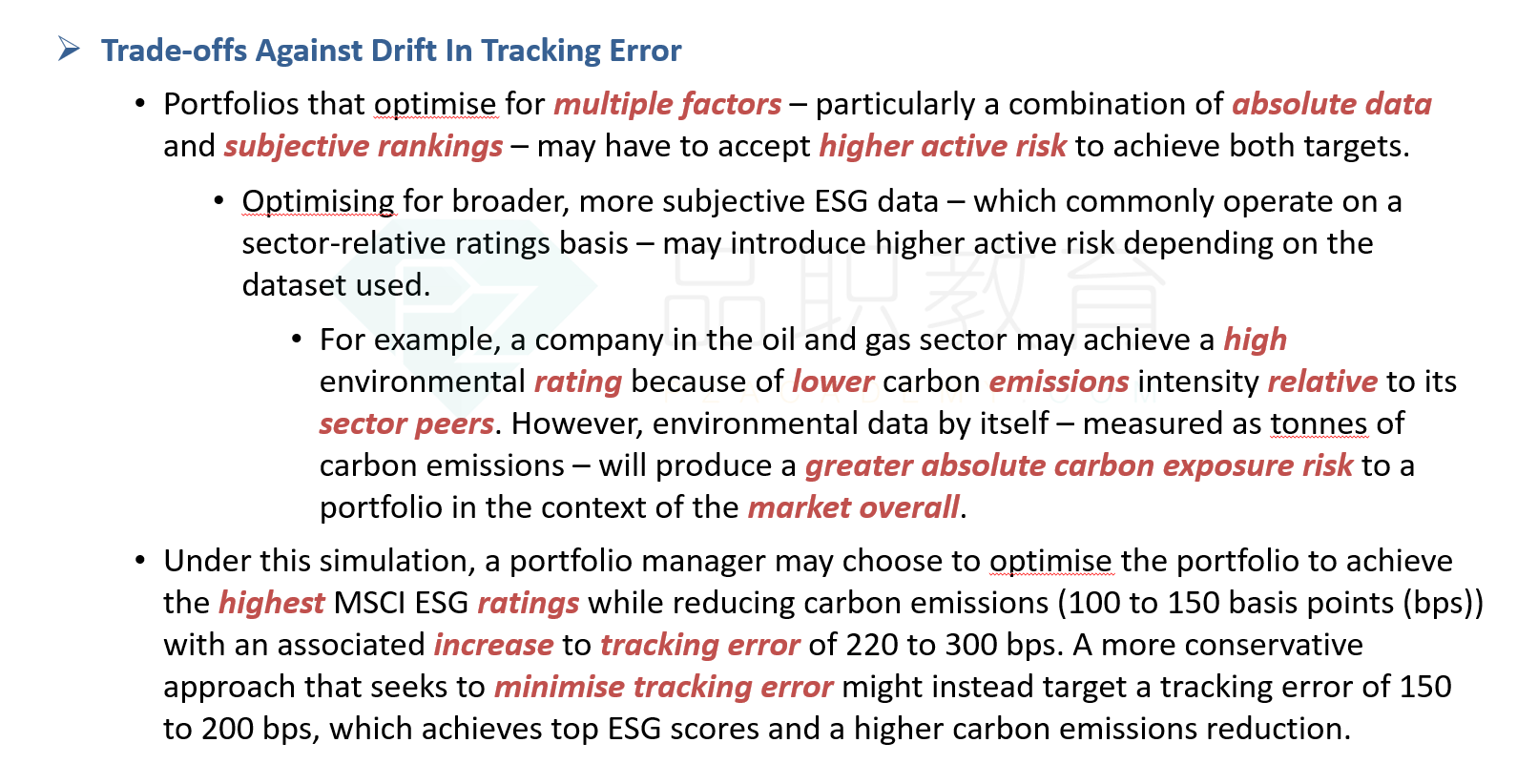

Will optimizing a portfolio for multiple ESG factors most likely affect the portfolio's tracking error?选项:

A.No B.Yes, optimizing will reduce tracking error C.Yes, optimizing will increase tracking error解释:

C is correct because portfolios that optimise for multiple factors – particularly a combination of absolute data and subjective rankings – may have to accept higher active risk to achieve both targets. Under this simulation, a portfolio manager may choose to optimise the portfolio to achieve the highest MSCI ESG ratings while reducing carbon emissions (100 to 150 basis points (bps)) with an associated increase to tracking error of 220 to 300 bps.该题目出现在讲义的哪里?