NO.PZ2024042601000057

问题如下:

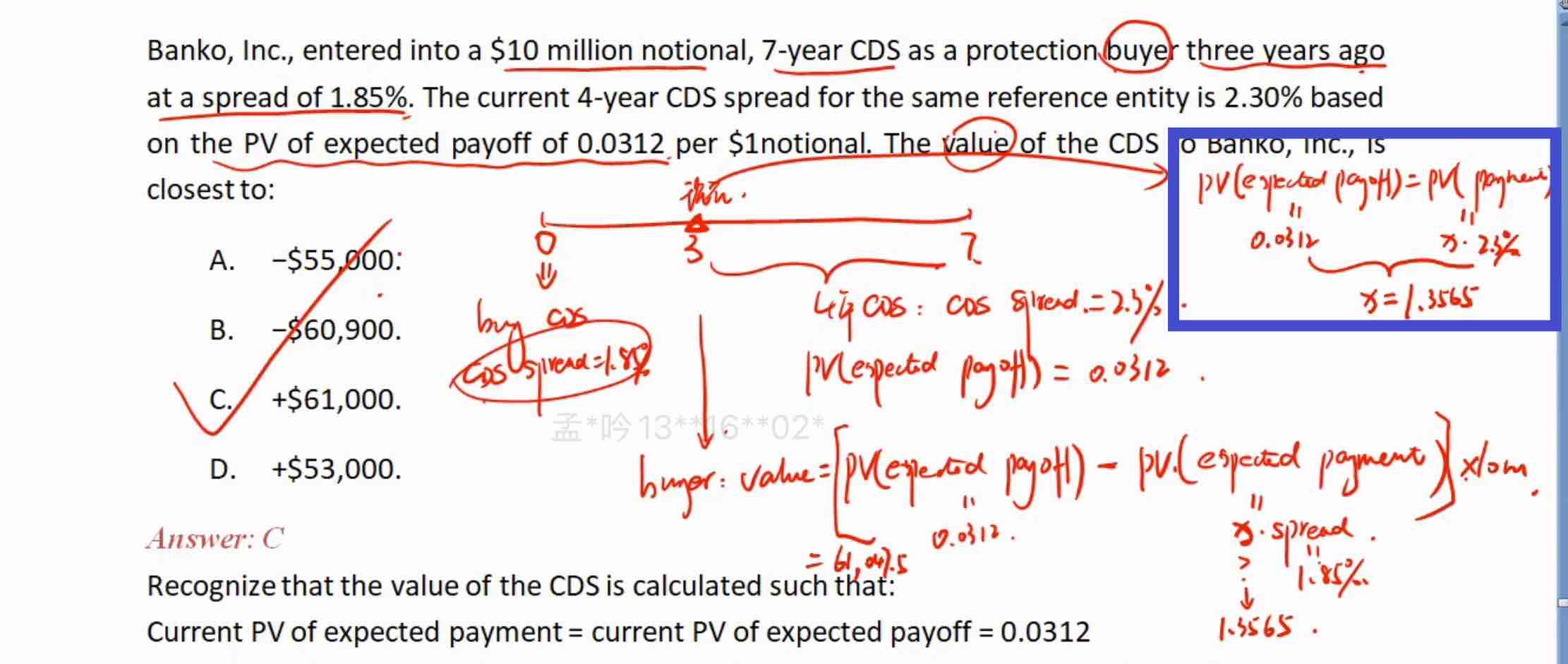

Banko, Inc., entered into a $10 million notional, 7-year CDS as a protection buyer three years ago at a spread of 1.85%. The current 4-year CDS spread for the same reference entity is 2.30% based on the PV of expected payoff of 0.0312 per $1 notional. The value of the CDS to Banko, Inc., is closest to:

选项:

A.

−$55,000

B.

−$60,900

C.

+$61,000

D.

+$53,000

解释:

Recognize that the value of the CDS is calculated such that:

Current PV of expected payment = current PV of expected payoff = 0.0312

Using the current spread of 2.30%, the current PV of expected payments = s=0.312/0.023=1.3565

Applying this value to the initial CDS spread of 1.85% yields:

PV of expected payments = 0.0185*1.3565=0.0251

Value to the protection buyer = PV of expected payoff - PV of expected payments = 0.0312 - 0.0251 = 0.0061 per 1$ notional.

The swap value for the $10 million notional = 0.0061 × 10,000,000 = $61,000. Because the spread has widened, the protection buyer gains.

老师,蓝框的现值具体是哪个时刻的价值?现在不是已经进入到第四年了吗?现在买cds是2.3%,2.3%不是已经是现值了吗?