问题如下:

Susan Winslow manages bond funds denominated in US Dollars, Euros, and British Pounds. Each fund invests in sovereign bonds and related derivatives. Each fund can invest a portion of its assets outside its base currency market with or without hedging the currency exposure, but to date Winslow has not utilized this capacity. She believes she can also hedge bonds into currencies other than a portfolio’s base currency when she expects doing so will add value. However, the legal department has not yet confirmed this interpretation. If the lawyers disagree, Winslow will be limited to either unhedged positions or hedging into each portfolio’s base currency.

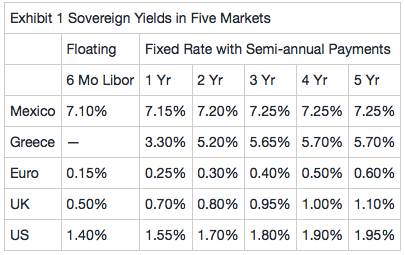

Winslow thinks the Mexican and Greek markets may offer attractive opportunities to enhance returns. Yields in these markets are given in Exhibit 1, along with those for the base currencies of her portfolios. The Greek rates are for euro-denominated government bonds priced at par. In the other markets, the yields apply to par sovereign bonds as well as to the fixed side of swaps versus six-month Libor (i.e., swap spreads are zero in each market). The six-month Libor rates also represent the rates at which investors can borrow or lend in each currency. Winslow observes that the five-year Treasury-note and the five-year German government note are the cheapest to deliver against their respective futures contracts expiring in six months.

Winslow expects yields in the US, Euro, UK, and Greek markets to remain stable over the next six months. She expects Mexican yields to decline to 7.0% at all maturities. Meanwhile, she projects that the Mexican Peso will depreciate by 2% against the Euro, the US Dollar will depreciate by 1% against the Euro, and the British Pound will remain stable versus the Euro. Winslow believes bonds of the same maturity may be viewed as having the same duration for purposes of identifying the most attractive positions.

Based on these views, Winslow is considering three types of trades. First, she is looking at carry trades, with or without taking currency exposure, among her three base currency markets. Each such trade will involve extending duration (e.g., lend long/borrow short) in no more than one market. Second, assuming the legal department confirms her interpretation of permissible currency hedging, she wants to identify the most attractive five-year bond and currency exposure for each of her three portfolios from among the five markets shown in Exhibit 1. Third, she wants to identify the most attractive five-year bond and hedging decision for each portfolio if she is only allowed to hedge into the portfolio’s base currency.

If Winslow is allowed to hedge into any of the currencies, she can obtain the highest expected returns by

选项:

A.buying the Greek 5-year in each portfolio and hedging it into Pesos

buying the Greek 5-year in each portfolio and hedging it into USD.

C.buying the Mexican 5-year in each portfolio and not hedging the currency

解释:

A is correct.

As shown in the previous question, the Greek bond is the most attractive. Although the Peso is expected to depreciate by 2% against the EUR and the GBP and by 1% against the USD, this is less than the benefit of hedging EUR into MXN (+3.475%). The net currency component of the expected return is +1.475% = (3.475% – 2.0%) for the EUR and GBP portfolios and +2.475% = (3.475% – 1.0%) for the USD-denominated portfolio. Hedging into GBP would add only 0.175% for any of the portfolios. Hedging into USD would reduce expected return for any of the portfolios because the pick up on the hedge (+0.625%) is less than the expected depreciation (–1.0%) of the USD against the Euro and GBP.

B is incorrect. Hedging the Euro-denominated Greek bond into USD would reduce expected return for any of the portfolios because the pick on the hedge (+0.625%) is less than the expected depreciation of the USD against the Euro and GBP.

C is incorrect. As shown above, the Greek bond is more attractive than the Mexican bond.

1. 可以再补充些解答信息吗?

按照视频,何旋老师的讲解思路: 如果hedge, EUR hedge into MXN, 则 R(fx) = R(MXN) -R(EUR), 这个数值要比

R(USD) -R(EUR), 所以选择A.

这个思路和这道题的解答思路不一致?

2. 这部分的解答没看明白

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

同理,对于USD账户,最终核算的收益为USD,所以将希腊债的EUR收益Hedge成了MXN之后,还需要将MXN收益再用未来预期的即期汇率换回USD;

因为预测MXN相对USD贬值1%,所以先把希腊债的EUR收益Hedge成MXN收益,再按即期汇率将MXN收益换回USD收益,获得的净收益为:

3.475%-1%=2.475%;

也就是不考虑债券投资,对USD账户,先把EUR收益用Forward hedge成MXN,再用预期的未来即期汇率将MXN收益换回USD收益,就额外增加了2.475%的收益。

如果不进行这步操作,对于USD账户,预期EUR相对USD升值1%,把希腊债EUR收益换回USD的收益仅仅为1%。

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

2.475% 大于 3.475% - 2% = 1.475%;那不是该选B了吗?