问题如下:

3. Based on Exhibit 2, the price-to-book multiple for Centralino is closest to:

选项:

A.2.0.

B.2.2.

C.2.5.

解释:

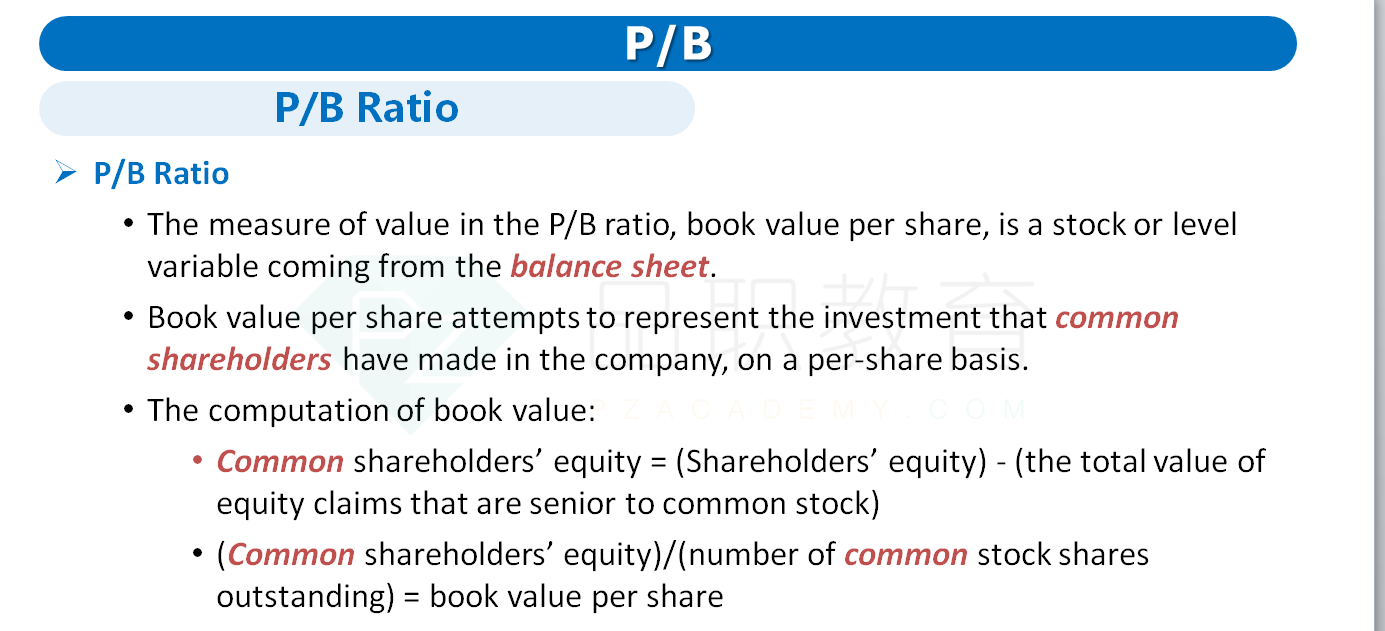

B is correct. Price to book is calculated as the current market price per share divided by book value per share. Book value per share is common shareholders’ equity divided by the number of common shares outstanding. Common shareholders’ equity is calculated as total shareholders’ equity minus the value of preferred stock

Thus:

Common shareholders’ equity = €1,027 – €80 = €947 million

Book value per share = €947 million/41.94 million = €22.58

Price-to-book ratio (P/B) for Centralino = €50/€22.58 = 2.2

分母确定是不加preferred share吗 为什么我之前好像做过的题有需要加preferred share按总的share outstanding作为分母的 是我记错了吗