问题如下图:

选项:

A.

B.

C.

为什么我们在计算Pv 时候,假设FV为0? 解释:

星星_品职助教 · 2019年12月11日

同学你好,

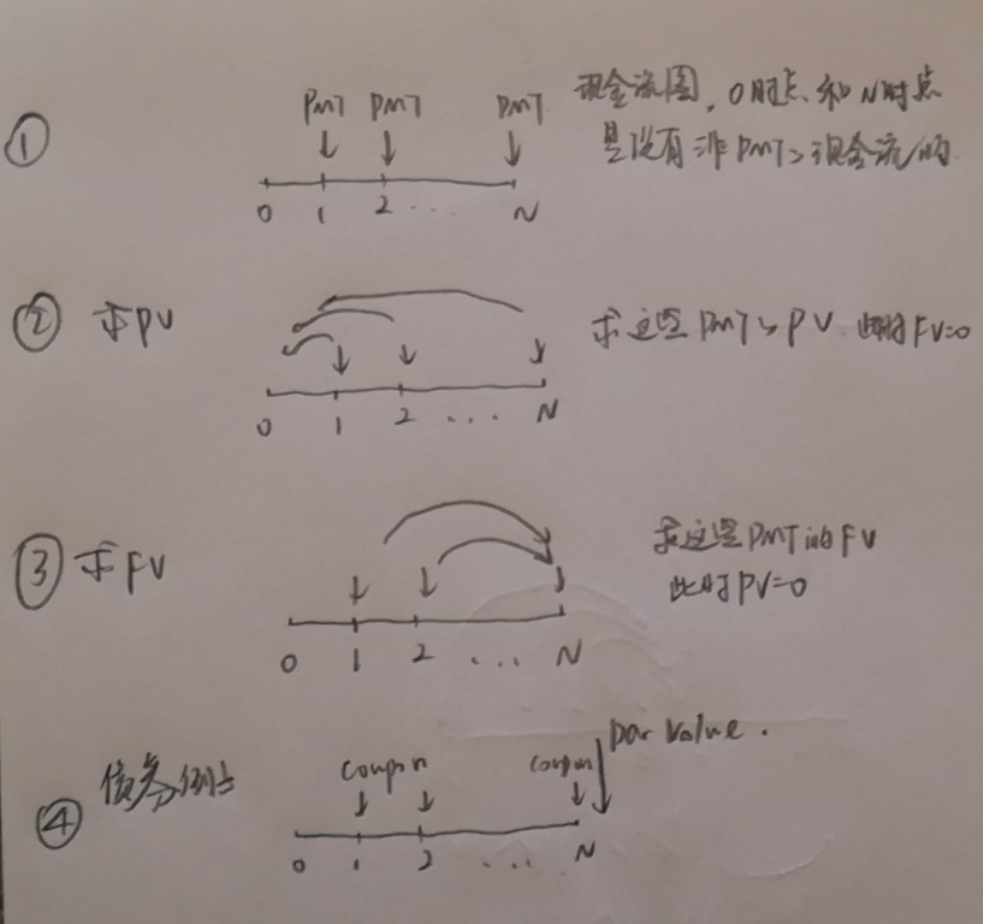

以年金为例,年金有的其实只是一系列等额等间距的现金流,也就是PMT,在年金的0时点,和最后一期N时点,是没有除了PMT以外的现金流的。也就是说,PV和FV都是根据这些PMT求出来的,而不是本来就存在的现金流。如以下第一张图。

所以当求PV的时候,由于N时点没有(除PMT以外)的现金流,这个时候FV就是0,如以下第二张图。

当求FV时,由于0时点也没有现金流,所以这个时候PV=0。如以下第三张图。

但有一种情况FV是不为0的,就是固收里即将学到的债券,因为在N时点是有一笔面值(par value)要付的,所以除了PMT外还有一笔现金流,这个时候按计算器的时候,FV不是0,而是Par value 的值。如以下第四张图。

加油~

NO.PZ2015120604000013问题如下 annuity of $2,000 per yewill receivefor twenty years. The first payment is to receivethe enof thirteenth years. Assume the scount rate is 7% over next years, calculate the toy's present value of the annuityA.$8,792.B.$9,408.C.$10,066. B is correct. Calculate the PV of annuity the enof the twentieth years : N = 20; I/Y = 7; PMT = -2,000; FV = 0; CPT PV = 21,188.03. ; Calculate the PV toy: N = 12; PMT = 0; FV = -21,188.03; I/Y = 7; CPT PV = 9,407.74. 这题时间线没看懂能不能一下

NO.PZ2015120604000013问题如下annuity of $2,000 per yewill receivefor twenty years. The first payment is to receivethe enof thirteenth years. Assume the scount rate is 7% over next years, calculate the toy's present value of the annuityA.$8,792.B.$9,408.C.$10,066. B is correct. Calculate the PV of annuity the enof the twentieth years : N = 20; I/Y = 7; PMT = -2,000; FV = 0; CPT PV = 21,188.03. ; Calculate the PV toy: N = 12; PMT = 0; FV = -21,188.03; I/Y = 7; CPT PV = 9,407.74. 如題 看不懂toy的時刻

NO.PZ2015120604000013 问题如下 annuity of $2,000 per yewill receivefor twenty years. The first payment is to receivethe enof thirteenth years. Assume the scount rate is 7% over next years, calculate the toy's present value of the annuity A.$8,792. B.$9,408. C.$10,066. B is correct. Calculate the PV of annuity the enof the twentieth years : N = 20; I/Y = 7; PMT = -2,000; FV = 0; CPT PV = 21,188.03. ; Calculate the PV toy: N = 12; PMT = 0; FV = -21,188.03; I/Y = 7; CPT PV = 9,407.74. 是否可以这样理解第一步求出的13时点的PV实际是12时点的年末值FV,第二步往前折的起算点得从12时点算,所以才是N=12

NO.PZ2015120604000013 问题如下 annuity of $2,000 per yewill receivefor twenty years. The first payment is to receivethe enof thirteenth years. Assume the scount rate is 7% over next years, calculate the toy's present value of the annuity A.$8,792. B.$9,408. C.$10,066. B is correct. Calculate the PV of annuity the enof the twentieth years : N = 20; I/Y = 7; PMT = -2,000; FV = 0; CPT PV = 21,188.03. ; Calculate the PV toy: N = 12; PMT = 0; FV = -21,188.03; I/Y = 7; CPT PV = 9,407.74. 之前也有一个说first payment in 5 quarters. 这道题是 first payment will happen the enof 13th year,都是求PV。 所以怎么理解这个first payment与present的关系,这个first payment都是未来发生的情况?这道题里面,如果first payment是在第十三年发生, 那么之前是没有现金流入的呀。the beginning of the 13th year应该是时点零,算这个时点的PV的话,N等于8, I/Y=7,PMT=-20000,FV=0。然后这个PV等于十二年后的FV,再折现得到现在的PV?如果按照答案解析里面,开始算PV就是N=20,那等于说在开始12年都是有payment的,跟题干要求不一致呢,怎么理解呢?

NO.PZ2015120604000013 问题如下 annuity of $2,000 per yewill receivefor twenty years. The first payment is to receivethe enof thirteenth years. Assume the scount rate is 7% over next years, calculate the toy's present value of the annuity A.$8,792. B.$9,408. C.$10,066. B is correct. Calculate the PV of annuity the enof the twentieth years : N = 20; I/Y = 7; PMT = -2,000; FV = 0; CPT PV = 21,188.03. ; Calculate the PV toy: N = 12; PMT = 0; FV = -21,188.03; I/Y = 7; CPT PV = 9,407.74. 老师,我实在绕不过来,很笨地画了一个图,如图,在第13年底收到第一笔2000,往后收20次。第一步折现到PV13,我没有问题,第二步折现到0时刻,这个箭头怎么数都是13个啊,所以我觉得N应该是13