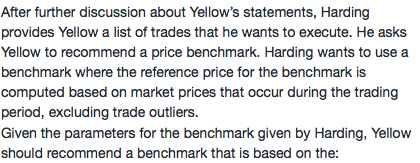

问题如下图:

选项:

A.

B.

C.

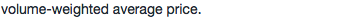

解释:

VWAP不可以exclude outlier吗?为什么呢

NO.PZ2020020202000008 问题如下 After further scussion about Yellow’s statements, Harng provis Yellow a list of tras thhe wants to execute. He asks Yellow to recommena pribenchmark. Harng wants to use a benchmark where the referenprifor the benchmark is computebaseon market prices thoccur ring the trang perio exclung tra outliers.Given the parameters for the benchmark given Harng, Yellow shoulrecommena benchmark this baseon the: A.arrivprice. B.time-weighteaverage price. C.volume-weighteaverage price. B is correct.Harng askeYellow to execute a list of tras, anhe wants to use a pribenchmark where the referenprifor the benchmark is computebaseon market prices thoccur ring the trang perio exclung tra outliers. Portfolio managers often specify intray benchmark for fun thare trang passively over the y, seeking liquity, anfor fun thmrebalancing, executing a buy/sell tra list, anminimizing risk. intray pribenchmark is baseon a prithoccurs ring the trang perio The most common intray benchmarks usein trang are volume-weighteaverage pri(VWAP) antime-weighteaverage pri(TWAP). Portfolio managers choose TWwhen they wish to exclu potentitra outliers. 除了剔除tra outliers还有什么判断的因素?

NO.PZ2020020202000008 问题如下 After further scussion about Yellow’s statements, Harng provis Yellow a list of tras thhe wants to execute. He asks Yellow to recommena pribenchmark. Harng wants to use a benchmark where the referenprifor the benchmark is computebaseon market prices thoccur ring the trang perio exclung tra outliers.Given the parameters for the benchmark given Harng, Yellow shoulrecommena benchmark this baseon the: A.arrivprice. B.time-weighteaverage price. C.volume-weighteaverage price. B is correct.Harng askeYellow to execute a list of tras, anhe wants to use a pribenchmark where the referenprifor the benchmark is computebaseon market prices thoccur ring the trang perio exclung tra outliers. Portfolio managers often specify intray benchmark for fun thare trang passively over the y, seeking liquity, anfor fun thmrebalancing, executing a buy/sell tra list, anminimizing risk. intray pribenchmark is baseon a prithoccurs ring the trang perio The most common intray benchmarks usein trang are volume-weighteaverage pri(VWAP) antime-weighteaverage pri(TWAP). Portfolio managers choose TWwhen they wish to exclu potentitra outliers. 如题